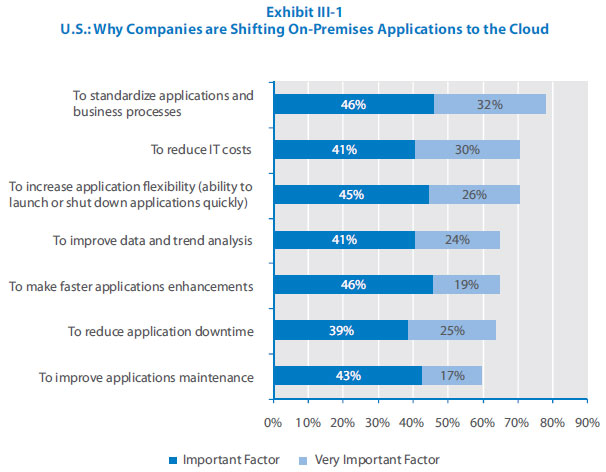

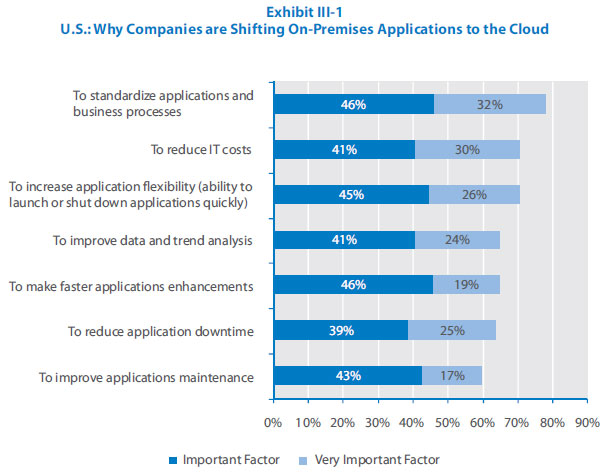

The biggest driver of cloud applications is not to cut IT costs. IT cost reduction is an important factor, but not the most important.

Rather, standardizing software applications and business processes across a company (in the U.S. and Asia-Pacific) and ramping systems up or down faster (in

Europe and Latin America) are the most highly rated drivers for shifting on-premises applications to the cloud. And the factors driving companies to

launch entirely new applications in the cloud are quite different – to institute new business processes and launch new technology-dependent products and

services. The case of assessment testing company CTB/McGraw-Hill shows why cloud computing will become a key tool for delivering pioneering IT-enabled offerings.

We asked companies to rate on a scale of importance (1 to 5) what had driven them to implement two kinds of cloud applications:

motivations for adopting cloud applications. We’ll start with the factors that

pushed companies to shift on-premises apps to the cloud.

Shifting On-Premises Apps to the Cloud: IT Cost-Cutting Isn’t the Leading Driver

Among U.S. and Asia-Pacific companies, the most important driver of shifting on-premises applications to the cloud is not what many think it would be – to

reduce technology costs (although that is a key driver). Ahead of that is something that is not as well understood by the press, analysts and others

covering cloud trends: standardizing applications and the business operations that those applications support.

Numerous large companies – especially those with multiple business units/divisions – are saddled with huge duplications in technologies: commercial

application software packages, hardware and data centers that are serve individual business units (and sometimes even just a single compute-intensive

business function such as R&D or manufacturing in a division). By giving companies the ability to take such applications out of departmental or business

unit data centers and put them in a centrally accessible location – a private or public data center that hosts the applications – cloud computing creates the

prospect of standardizing applications across a big business.

The major telco that we spoke with said offering standardized cloud applications will help its business units reduce their IT costs and the need for

so many data centers (which today are in the hundreds). Having dozens of financial, HR, customer management and other applications today – each devoted

to a narrow slice of its business – has resulted in huge IT costs (software, hardware and data centers). In fact, the company believes that its shift to

cloud applications will help it reduce its number of data centers by 80%, which would produce an estimated annual cost savings of $100 million to $200

million.

Another highly rated driver of cloud applications in both the U.S. and Asia-Pacific companies was increasing applications or systems “flexibility.” In

both regions, this was the third most important driver of shifting on-premises applications to the cloud. What does this mean? It refers to the ability to

scale an application up or down.

Rather, standardizing software applications and business processes across a company (in the U.S. and Asia-Pacific) and ramping systems up or down faster (in

Europe and Latin America) are the most highly rated drivers for shifting on-premises applications to the cloud. And the factors driving companies to

launch entirely new applications in the cloud are quite different – to institute new business processes and launch new technology-dependent products and

services. The case of assessment testing company CTB/McGraw-Hill shows why cloud computing will become a key tool for delivering pioneering IT-enabled offerings.

- Factors driving companies to shift on-premises applications to the cloud

- Factors driving companies to launch whole new applications in the cloud

- Case study: CTB/McGraw-Hill

We asked companies to rate on a scale of importance (1 to 5) what had driven them to implement two kinds of cloud applications:

- Cloud applications that had previously been installed on on-premises computers

- Entirely new cloud-based applications for which there had been no

on-premises versions before

motivations for adopting cloud applications. We’ll start with the factors that

pushed companies to shift on-premises apps to the cloud.

Shifting On-Premises Apps to the Cloud: IT Cost-Cutting Isn’t the Leading Driver

Among U.S. and Asia-Pacific companies, the most important driver of shifting on-premises applications to the cloud is not what many think it would be – to

reduce technology costs (although that is a key driver). Ahead of that is something that is not as well understood by the press, analysts and others

covering cloud trends: standardizing applications and the business operations that those applications support.

Numerous large companies – especially those with multiple business units/divisions – are saddled with huge duplications in technologies: commercial

application software packages, hardware and data centers that are serve individual business units (and sometimes even just a single compute-intensive

business function such as R&D or manufacturing in a division). By giving companies the ability to take such applications out of departmental or business

unit data centers and put them in a centrally accessible location – a private or public data center that hosts the applications – cloud computing creates the

prospect of standardizing applications across a big business.

The major telco that we spoke with said offering standardized cloud applications will help its business units reduce their IT costs and the need for

so many data centers (which today are in the hundreds). Having dozens of financial, HR, customer management and other applications today – each devoted

to a narrow slice of its business – has resulted in huge IT costs (software, hardware and data centers). In fact, the company believes that its shift to

cloud applications will help it reduce its number of data centers by 80%, which would produce an estimated annual cost savings of $100 million to $200

million.

Another highly rated driver of cloud applications in both the U.S. and Asia-Pacific companies was increasing applications or systems “flexibility.” In

both regions, this was the third most important driver of shifting on-premises applications to the cloud. What does this mean? It refers to the ability to

scale an application up or down.

The need to process “big data” – huge volumes of transactional and other digitized data (video, social media chatter, and other) — appears to be a big driver of cloud applications. Nearly two-thirds (65%) of the U.S. survey respondents they were driven to the cloud to improve the way they gathered and analyzed data (rated as an important or very important factor). A similar number of Asia-Pacific companies said this was an important or very important driver of their shift to the cloud. Less than half (47%) of the European companies said it was an important or very important factor in using cloud. However, 80% of the Latin American companies said this was an important or very important factor. One of the biggest differences that we found between the companies that had generated the largest benefits from the cloud and the ones that had generated the least benefits was, in fact, their interest in using the cloud to manage “big data.”

Big Data and the Push for Cloud

Our U.S. data shows that savvier uses of cloud applications are distinct in many ways – one of which is their interest in using the cloud to process and analyze volumes of digital data.

We compared the answers of the companies in the top quartile of benefits achieved from shifting on-premises apps to the cloud (the “leaders”) to those in the bottom quartile (“laggards”). Some 74% of the leaders said using the cloud to process and analyze data for trend identification was important or very important. But a much lower percentage of laggards (55%) said that was a key driver.

Big Data and the Push for Cloud

Our U.S. data shows that savvier uses of cloud applications are distinct in many ways – one of which is their interest in using the cloud to process and analyze volumes of digital data.

We compared the answers of the companies in the top quartile of benefits achieved from shifting on-premises apps to the cloud (the “leaders”) to those in the bottom quartile (“laggards”). Some 74% of the leaders said using the cloud to process and analyze data for trend identification was important or very important. But a much lower percentage of laggards (55%) said that was a key driver.

|

We found a similar set of drivers in the Asia-Pacific companies that we polled. The three most important drivers in this region – just like in the U.S. – were 1) standardizing applications and business processes, 2) reducing IT costs, and 3) increasing application flexibility.

The biggest factor driving Commonwealth Bank of Australia to shift on-premises applications to its private cloud was to use the savings in IT costs to providing more bank services through mobile applications and social media. “For us, cloud is not just about on-demand, selective scalability and automation,” says Rajasingham. “It’s also about self-funding IT, removing cost from running the business – and reallocating that into delivering more value-added services.” |

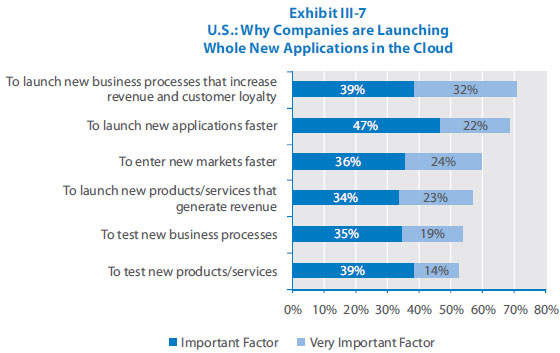

Why Companies are Launching Entirely New Applications in the Cloud: They Want to be Quicker to the Punch with New Business Processes

We also surveyed companies about any new applications that they launched in the cloud – applications for which they had no previous versions installed on their on-premises computers. In three of the four regions (all except for Europe), the factor rated as the most important was the need to institute new business processes to generate revenue and increase customer loyalty.This was not a surprise to us. Increasingly, companies are doing business with customers online, and cloud computing can give those businesses a faster route to changing the way they do business on the Web. The Web has become a critical place for many customers to find out about a company’s products and services, place orders, check on shipment status, and (post-delivery) get answers to questions about how to use the product or otherwise get support.

Take the case of Dell Inc., the multibillion-dollar supplier of innovative technology and technology services. One of the Round Rock, Texas-based company’s online marketing groups caters to large corporate and government customers (the Public and Large Enterprise business unit). It has put cloud applications at the center of the marketing tool strategy that it uses, according to Rishi Dave executive director of online marketing. Many vendors of online marketing tools – for example, those that assess social media influencers – provide their products via the cloud, he explained. Using cloud vendors’ applications enables Dell’s online marketing function to execute online marketing, social and community programs without having to “touch our internal infrastructure,” Dave explains.

The cloud helped Dell introduce gamification to customers and prospects at the 2011 Dell World conference. In the four months prior to Dell’s first Dell World client conference (which ran from Oct. 12-14, 2011 in Austin, Texas), Dell’s online marketing group decided to provide gamification to motivate customers to download Dell marketing content, visit physical locations at the conference, and network with each other. By using the cloud-based gamification services of one vendor, Dell was able to plan and execute the project in less than four months.

We also surveyed companies about any new applications that they launched in the cloud – applications for which they had no previous versions installed on their on-premises computers. In three of the four regions (all except for Europe), the factor rated as the most important was the need to institute new business processes to generate revenue and increase customer loyalty.This was not a surprise to us. Increasingly, companies are doing business with customers online, and cloud computing can give those businesses a faster route to changing the way they do business on the Web. The Web has become a critical place for many customers to find out about a company’s products and services, place orders, check on shipment status, and (post-delivery) get answers to questions about how to use the product or otherwise get support.

Take the case of Dell Inc., the multibillion-dollar supplier of innovative technology and technology services. One of the Round Rock, Texas-based company’s online marketing groups caters to large corporate and government customers (the Public and Large Enterprise business unit). It has put cloud applications at the center of the marketing tool strategy that it uses, according to Rishi Dave executive director of online marketing. Many vendors of online marketing tools – for example, those that assess social media influencers – provide their products via the cloud, he explained. Using cloud vendors’ applications enables Dell’s online marketing function to execute online marketing, social and community programs without having to “touch our internal infrastructure,” Dave explains.

The cloud helped Dell introduce gamification to customers and prospects at the 2011 Dell World conference. In the four months prior to Dell’s first Dell World client conference (which ran from Oct. 12-14, 2011 in Austin, Texas), Dell’s online marketing group decided to provide gamification to motivate customers to download Dell marketing content, visit physical locations at the conference, and network with each other. By using the cloud-based gamification services of one vendor, Dell was able to plan and execute the project in less than four months.

CTB/McGraw-Hill: Looking to the Cloud to Set the Pace in Online Student Testing CTB/McGraw-Hill is one of the three largest suppliers of assessment tests for public and private schools in the U.S. and other countries. Million of students in all 50 states take CTB’s tests. They help school districts and states rate the quality of the teaching delivered in their classrooms, as well as determine how to improve it.

The company, based in Monterey, Calif., believes cloud computing will be essential for competing in a highly price-sensitive market (U.S. public schools). CTB/McGraw-Hill also feels that cloud will be critical to shifting its testing services from a paper-and-pencil process to an online experience – one with great potential to improve teachers’ ability to address students’ learning deficiencies. The company believes cloud computing will be a crucial channel for delivering its products and services to school districts in the future.

But given the nature of CTB’s business – delivering tests to hundreds of thousands of K-12 students over two weeks each year – that creates enormous demand for the ability to scale computing resources up or down to administer online tests, which it believes will be the wave of the future. “Given that we have high spikes in capacity, we must be able to increase it and lower it quickly,” says CTB’s chief technology officer, Jayaram “Bala” Balachander. “We can’t do that today. That’s where cloud will be critical.”

In 2011, CTB delivered online assessment testing to 180,000 U.S. K-12 students over a two-week period. With each student taking as many as five tests, this meant the company had to score 800,000 online tests concurrently. “This lends itself very much to the cloud because we can go up or down depending on the activity in our business.” In 2012, the numbers are expected to more than double, creating an increasing need for ramping up and down infrastructure resources. As a result, CTB is experimenting with cloud-based solutions.

Balachander predicts that about a million U.S. students will take their assessment tests online (including CTB’s tests) in 2012. Moreover, with U.S. schools wanting 100% of their assessment testing to be online at some point, that would require CTB to have the computing resources to serve the online assessment needs of millions of American children in K-12 grades at once, a number he believes could be reached as early as 2015.

Even if that turns out to be a smaller number in three years – say 75% of the 55 million U.S. students take online assessment tests — if CTB commanded a 20% share of that market, it would need computing resources to support the delivery and scoring of more than 40 million tests in a short period of time. “It would be very difficult for us to do that without the cloud – to invest in the infrastructure from a capital expenditure standpoint, and then make the ongoing technology investments,” Balachander explains.

By this August, CTB intends to shift six to eight on-premises applications to the cloud, one of which is the online testing. The firm’s website and extranet are also being evaluated as potential candidates to put in the cloud.

Balachander believes all new CTB applications should be cloud applications. “With new applications, we are saying that by default we should put them in the cloud.”

“At the end of the day, CTB needs IT services that can adapt to varying scalability demands,” Balachander says. “We clearly don’t want to invest in fixed infrastructure costs to handle our spikes in volume and scalability. The current set of cloud services and ongoing advances in technology in this area give us an ability to approach our infrastructure needs in a whole different way.”

The company, based in Monterey, Calif., believes cloud computing will be essential for competing in a highly price-sensitive market (U.S. public schools). CTB/McGraw-Hill also feels that cloud will be critical to shifting its testing services from a paper-and-pencil process to an online experience – one with great potential to improve teachers’ ability to address students’ learning deficiencies. The company believes cloud computing will be a crucial channel for delivering its products and services to school districts in the future.

But given the nature of CTB’s business – delivering tests to hundreds of thousands of K-12 students over two weeks each year – that creates enormous demand for the ability to scale computing resources up or down to administer online tests, which it believes will be the wave of the future. “Given that we have high spikes in capacity, we must be able to increase it and lower it quickly,” says CTB’s chief technology officer, Jayaram “Bala” Balachander. “We can’t do that today. That’s where cloud will be critical.”

In 2011, CTB delivered online assessment testing to 180,000 U.S. K-12 students over a two-week period. With each student taking as many as five tests, this meant the company had to score 800,000 online tests concurrently. “This lends itself very much to the cloud because we can go up or down depending on the activity in our business.” In 2012, the numbers are expected to more than double, creating an increasing need for ramping up and down infrastructure resources. As a result, CTB is experimenting with cloud-based solutions.

Balachander predicts that about a million U.S. students will take their assessment tests online (including CTB’s tests) in 2012. Moreover, with U.S. schools wanting 100% of their assessment testing to be online at some point, that would require CTB to have the computing resources to serve the online assessment needs of millions of American children in K-12 grades at once, a number he believes could be reached as early as 2015.

Even if that turns out to be a smaller number in three years – say 75% of the 55 million U.S. students take online assessment tests — if CTB commanded a 20% share of that market, it would need computing resources to support the delivery and scoring of more than 40 million tests in a short period of time. “It would be very difficult for us to do that without the cloud – to invest in the infrastructure from a capital expenditure standpoint, and then make the ongoing technology investments,” Balachander explains.

By this August, CTB intends to shift six to eight on-premises applications to the cloud, one of which is the online testing. The firm’s website and extranet are also being evaluated as potential candidates to put in the cloud.

Balachander believes all new CTB applications should be cloud applications. “With new applications, we are saying that by default we should put them in the cloud.”

“At the end of the day, CTB needs IT services that can adapt to varying scalability demands,” Balachander says. “We clearly don’t want to invest in fixed infrastructure costs to handle our spikes in volume and scalability. The current set of cloud services and ongoing advances in technology in this area give us an ability to approach our infrastructure needs in a whole different way.”